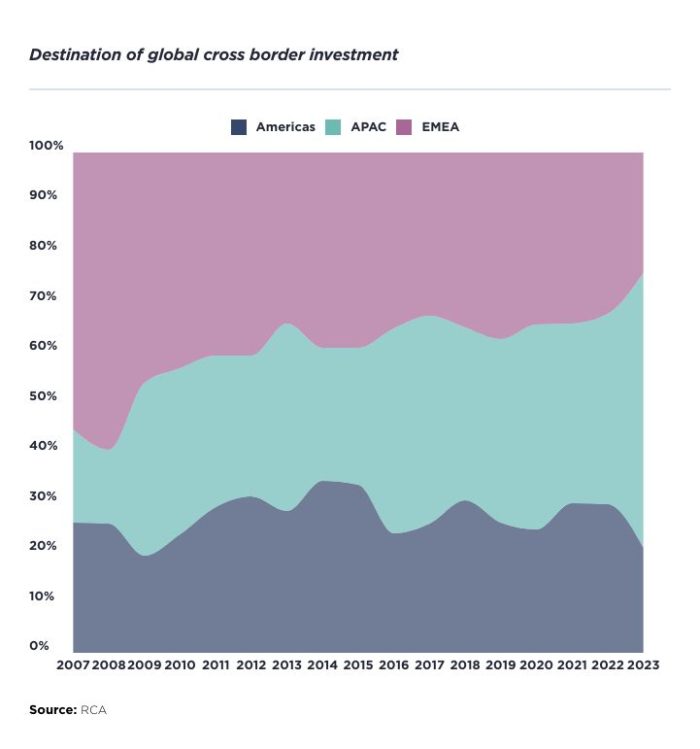

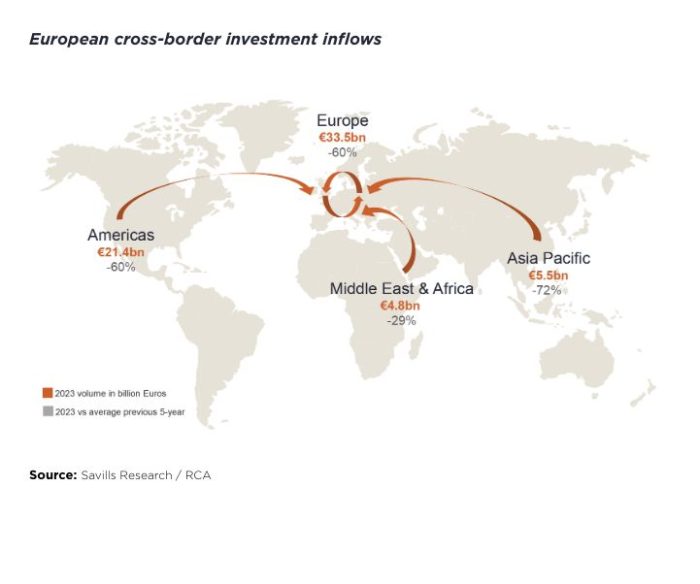

In light of repricing driven by interest rate increases, global cross border investment in real estate amounted to €196.3bn, 40% down on the five-year average, with declining inflows across all continents, according to RCA. However, EMEA was hardest hit, recording a 59% decrease on the five-year average (-56% from the American continent and -12% from Asia-Pacific). Hence, the Asia-Pacific region solidified its position as the primary destination for global cross border investments for the fourth consecutive year, highlighting its remarkable resilience. Meanwhile, Europe experienced a decline, with its share of global cross border volumes dropping to 24% last year, its nadir.

We believe the obstacles to cross border investment in Europe are driven by conjectural influences conditioned by recent episodes of geopolitical tension and heightened inflation rather than longer-term structural shortcomings. This is why we anticipate Europe will likely reclaim its leading position as the foremost destination for cross border investments in the next 12 to 18 months, but where will the money come from, and how will it be attributed across European countries and asset classes?